How Cannabis Cultivators Are Adapting to Market Trends in 2024 and Beyond

As we close out 2024, we take a moment to reflect on the key discussions, trends, and insights that have shaped the year, while looking ahead to what’s in store for 2025. We’ve gathered perspectives from cultivators on how the year unfolded, as well as what trends and opportunities they anticipate for the year ahead.

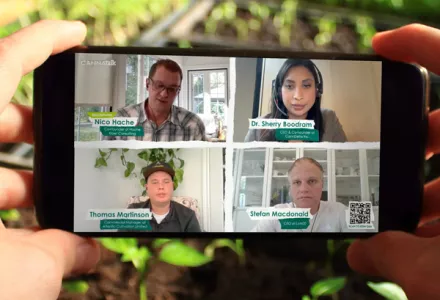

PANEL:

International Expansion: A Growing Focus

International markets have continued to dominate conversations throughout the year, with all three panelists focusing on emerging global opportunities. For many, expanding internationally has become a vital part of their growth strategy:

- Origine Nature has prioritized international expansion, with 20-25% of its biomass now allocated for export.

- Lot420 leveraged its first-mover advantage to establish a premium brand in six countries, making international sales a cornerstone of its business.

- Noble Growth remains primarily focused on domestic sales in 2024 but is gearing up to expand into international markets in 2025.

Evolving Market Trends & Segmentation

Market segmentation in 2024 saw a significant shift, driven by evolving consumer preferences and emerging product trends. Notably:

- Pre-rolls overtook dry flower sales over the summer, propelled by increasing consumer demand for convenience and consistency—a rapid shift that took some businesses by surprise.

- The market also split more distinctly into bargain, value, and premium segments, with a growing demand for infused products and hash.

- This evolution has emphasized the importance of efficient flower sorting, particularly by using smalls for pre-rolls and extraction.

Production Costs: A Persistent Challenge

Production costs remain a critical focus, with efficiency being essential for competitiveness in both domestic and international markets. While international markets often offer higher sale prices per gram, additional costs related to logistics, compliance, and regulations can offset those price advantages.

Panelists shared their cost benchmarks:

- For craft premium cannabis, production costs should ideally remain below $2/gram.

- For all other market segments, production costs should target around $1/gram.

The consensus is clear: regardless of the market—domestic or international—operating lean and efficiently is key to success.

Brand Recognition: Consistency Is Key

Brand recognition is essential, but consistency remains the foundation of a strong brand. Here’s what the panelists had to say:

- Jesse: "Brand recognition is huge for us. With our deep legacy roots, we’ve found that international advertising is less regulated than in Canada, making strategic partnerships crucial to amplifying our brand overseas."

- Stefan: "Branding is important, but it must be backed by quality cannabis. We dedicate around 5% of our budget to branding, focusing heavily on the consumer experience."

- Alex: "Currently, we’re only branding in Quebec, and for us, the best marketing comes from the product itself. Word of mouth is key. And because we white label on the international market, we rely on quality and consistency and the product has to match the packaging to build repeat business."

Looking Ahead to 2025

The panelists shared their strategies for 2025, with a strong emphasis on international growth, refining product offerings, and enhancing brand presence:

- Expanding packaging capacity, particularly for pre-rolls.

- Doubling and strengthening international exports, focusing on key global markets.

- Expanding product offerings in flowers, pre-rolls, and concentrates.

- Building a robust medical cannabis platform.

That concludes our CANNAtalk program for 2024, and we want to thank everyone for participating in the discussions and tuning-in for the knowledge. We look forward to a new season of CANNAtalk in 2025!